In today's globalized world, migration has come to be a typical sensation. People leave their home nations in hunt of much better economic opportunities, education and learning, or just to run away dispute or oppression. One country that experiences significant outside migration is India. According to the World Bank, India is the biggest receiver of discharges around the world, along with an determined $83 billion in 2020. These discharges play a critical duty in assisting loved ones left behind and possess a notable effect on the Indian economic condition as properly.

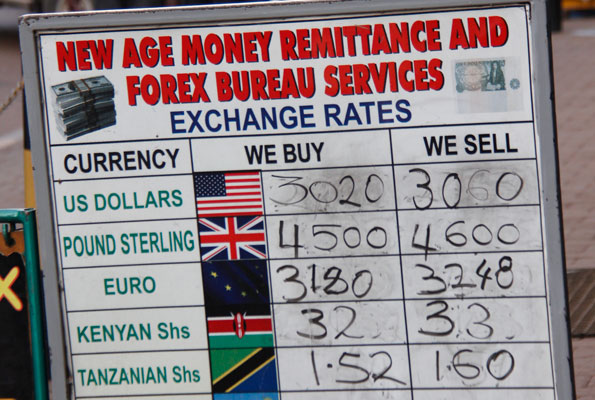

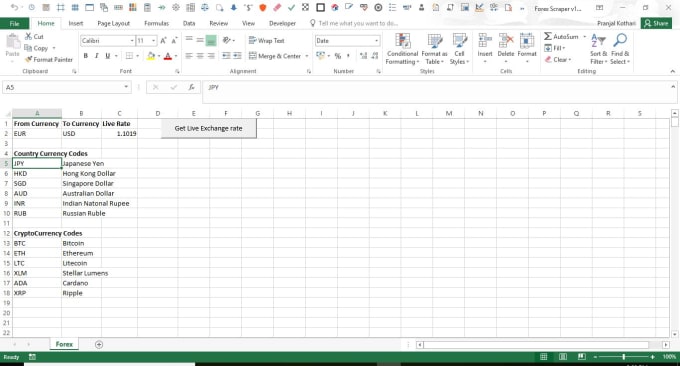

Discharges are determined as economic transmissions created through evacuees to their residence nations. They can easily be delivered through professional stations such as banks or money move drivers, or through laid-back networks like pals or relatives. In India, a sizable number of evacuees are working in Gulf nations such as Saudi Arabia, UAE, and Qatar. These evacuees often function in low-skilled jobs such as construction workers, domestic helpers, or motorists.

For numerous households in India, remittances are a lifeline that helps them satisfy their fundamental needs and improve their criterion of living. The loan sent out by evacuees is utilized for a variety of reasons such as education expenditures for little ones, healthcare expense, real estate enhancements, and starting little companies.

Education and learning is one location where remittances create a considerable influence on Indian families. Lots of parents make use of the funds acquired from abroad to participate their little ones in better universities or also deliver them overseas for higher education. This not only enhances the academic outcomes for these little ones but likewise opens up much better opportunities for them in the future.

Healthcare is one more sector where remittances play a essential duty in supporting households back home. Clinical expenditures may be fairly high in India, particularly for those without accessibility to quality medical care establishments. Remittances aid cover these price and make certain that families can easily access essential clinical treatments when needed.

In addition, remittances provide to enhancing housing ailments for loved ones in India. Travelers commonly send money back home to build or restore residences, supplying their households with more secure and extra comfy living environments. More Details enhances the general well-being of the household participants but additionally provides to the advancement of neighborhood communities.

In addition, remittances have a considerable impact on the Indian economy as a whole. The money delivered through travelers boosts international substitution gets, strengthens the Indian currency, and helps reduce the trade shortage. It additionally gives a steady resource of revenue for several families, lessening scarcity degrees and strengthening socio-economic health conditions.

Nonetheless, it is significant to acknowledge that there are actually obstacle associated along with discharges as properly. For instance, dependence on discharges can develop a feeling of smugness one of some recipients who might become conditional on this resource of profit rather than finding employment or entrepreneurial opportunities within India. Furthermore, fluctuations in worldwide financial health conditions can easily affect discharge flows and interrupt the financial security of families relying on them.

To make sure that discharges continue to have a favorable influence, policymakers need to concentrate on making an enabling atmosphere that encourages expenditure